2021 Fourth Quarter Newsletter

Helping investors achieve optimal risk adjusted returns on their financial assets using low cost investment vehicles.

Market Trends

DECEMBER 2021

SPY +28.6%, BND -2.0% SPY/GLD 2.8

TWI 60/30/10 ETF PORTFOLIO* +11.6.%

INFLATION?

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money then in output.” – Milton Friedman

If 2021 taught anyone a lesson in economics, it is this: governments cannot increase economic output in the future by injecting money into the economy of the past. Sure, it feels good in the past, but at the cost of higher prices for items in the future. Witness the dollar time machine called inflation, where dollars are borrowed from the future and spent today. Dollars are not just printed and distributed by the Federal Reserve, for each dollar that comes into existence the Fed must take in an offsetting asset. In days of old, what we now call banks, were groups that acted a bit like a pawn broker, a trader, or merchant taking in “output” such as a bag of ore, a bundle of wheat, or a deed for farmland in exchange for a marker. The marker could later be exchanged for other goods or services. Today in the U.S. we call those markers dollars. Dollars facilitate a much more efficient and rapid exchange of goods for services then those of a bartering system. It is an over simplification to think that for each dollar created there is or should be an exchangeable good behind it (like a fixed amount of gold for example). It took economists a long time to realize that was too static a view. It fails to recognize a litany of regional and temporal economic phenomena that affect the relative value of a dollar. The Fed, and its regional outlets were created to manage the supply of dollars for exactly these reasons. It is the Fed’s job to smooth out the abundance or shortage of dollars relative to output from region to region in real time. The Fed oversees the creation of dollars, but they are distributed through third parties. It does this by lowering or raising the rates it offers overnight to other banks to borrow against or deposit reserves, regulating how other banks loosen or tighten their lending standards, or by purchasing packages of mortgages from other banks. It is primarily the Fed’s expansive purchase of U.S. Treasury bonds and notes last year that produced the inflation we are experiencing now. That is because Congress and the administration directed most of these dollars into unproductive social programs that created a demand for, but did not increase, output. Rather predictably the administration’s policies decreased output. Managed correctly these effects can be reversed over the next year by the Fed as it stops buying Treasuries. However, as I will get to shortly, there are some longer-term demographic effects at work which may make the job more difficult.

U.S. Treasury bonds and notes are fundamentally promises to deliver to the buyer tax revenue dollars in the future. These instruments move tax revenue dollars, from the U.S. Treasuries’ future to today. Just imagine a version of the movie Back to the Future where Doc exclaims - “Great Scott Marty the Federal Reserve is a dollar time machine!” According to MMT (Modern Monetary Theory) the future is a long time from now, so there is an infinite supply of dollars to be brought back from the future. Except that it neglects the case where the future has less output than what is borrowed. Then dollars from the future create inflation today!

The demand for used cars and their pricing is a balance between savers and borrowers. Borrowing for used cars is a measure of inflationary demand. Recently the demand for used cars has reached record highs. This suggests the relative number of borrowers has increased to that of the number of savers. If one compares a long-term demographic chart of the ratio of folks aged 18-34 (those more likely to be borrowers) to the gross population, they will observe the level of inflation follows it nicely. Let’s call the relative amount of folks who are age 18-34 the Gamma ratio. So, when the Federal Reserve holds interest rates low, eases lending standards, the U.S. Treasury borrows massively and spends it social programs, and there is an increase of Gamma ratio you are going to observe a lot of inflation.

The investment in stock generally produces longer term (15-20 years forward) economic output. Gamma folks are more investment oriented, especially so when money is cheap to borrow and raining from the U.S. Treasury in the form of bonus unemployment benefits and advanced child tax credits. Gammas are more likely to have long term investment horizons and are more likely to speculate. One can surmise that Gamma’s are helping to drive inflation and the stock market today, but also long-term economic growth far in the future.

As further evidence of this Gamma phenomena we need look no further than the Japanese economy in the 1990’s. As Japan’s Gamma ratio tapered off there was the bust of the Nikkei 225, and similarly with the U.S.’s NASDAQ 100 crash in 2000 as the baby-boom Gamma receded. Interestingly, however, whereas the Japanese demographic has experienced a persistent Gamma reduction the U.S. had a mini boom of Gammas that resulted from latent baby boomer fecundity. This is theorized to have promoted the recently strong U.S. stock market and exacerbated government spurred inflation. It also suggests that the malaise that the EU markets have suffered are now due for a modest reversal, and the Chinese markets are headed for trouble. Of course, there are always trends within trends, new technological discoveries, wars, bad government policy, pandemics, etcetera, but over the long run demographics trump them all.

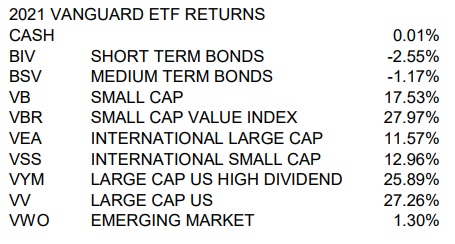

The market has pulled back to what my models rate as BUY! territory. If demographic fecundity does acts as a reliable long-term market prognosticator, right now it suggests investing in the VYM (Vanguard High Dividend Yield ETF) @ < $117/share, the VEA (Vanguard developed market ETF) @ < $49/share for those who are of an income-oriented inclination, or the VBR (Vanguard small cap value ETF) @ < $175/share (to add some buy low sell high volatility to your portfolio.) Longer term I recommend shifting away from funds heavily tilted toward China like the VWO (Vanguard emerging market ETF). See my fall newsletter for the recommended replacements: the FEMS (First Trust emerging market ETF) or the EWX (SPDR S&P emerging markets ETF). While interest rates are on the rise, even with a 0.1% return, cash is a better place for stability then bonds. Avoid fresh investments in bond funds for the next two quarters. Happy New Year!

*The percentages reported are year to date - December 31, 2021. The TWI 60/30/10 ETF PORTFOLIO is my custom 60 % stock / 30% bond / and 10% cash blend of Vanguard indexed based ETF's. The SPY is the S&P 500 trust ETF. The BND is Vanguards Total Bonds Market ETF.

Invest Wisely!

Douglas A. McClennen(508) 237-2316